- Home

- The Arizona News

- IRS Announces $30M Unclaimed for Arizonans That Did Not File 2017 Federal Income Tax Return

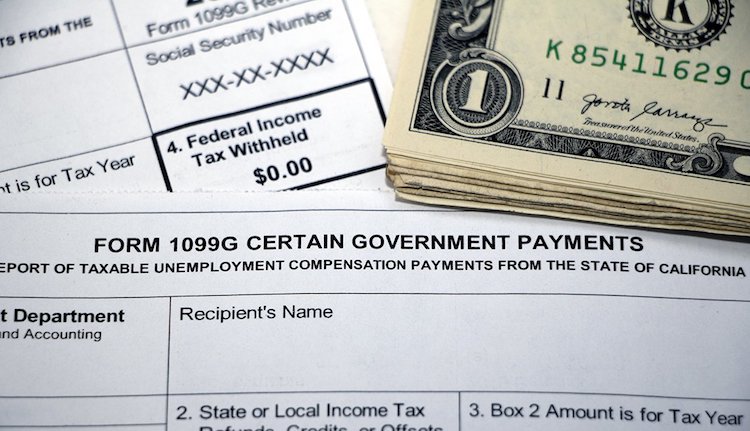

IRS Announces $30M Unclaimed for Arizonans That Did Not File 2017 Federal Income Tax Return

On Monday, the IRS announced that there are more than $1.3 billion in unclaimed income tax refunds for those who did not file a 2017 federal income tax return. Of that, more than $30 million is marked for Arizona taxpayers.

The IRS says it estimates the median for potential unclaimed 2017 refunds to be $865.

“The IRS wants to help taxpayers who are due refunds but haven’t filed their 2017 tax returns yet,” said IRS Commissioner Chuck Rettig. “Time is quickly running out for these taxpayers. There’s only a three-year window to claim these refunds, and the window closes on May 17. We want to help people get these refunds, but they will need to quickly file a 2017 tax return.”

By law, in most cases, taxpayers are allowed a three-year window of opportunity to claim their tax refund. If the tax return is not filed within three years, the money becomes property of the U.S. Treasury.

For 2017 tax returns, the window is set to close on Monday, May 17 for most taxpayers.

To receive your tax return, taxpayers are required to properly address, mail, and ensure the tax return is postmarked by the date of May 17, 2021.

For more information on tax forms, click here.