- Home

- The Feature

- Arizona Department of Revenue Warns Residents of Unemployment Fraud Tax Form

Arizona Department of Revenue Warns Residents of Unemployment Fraud Tax Form

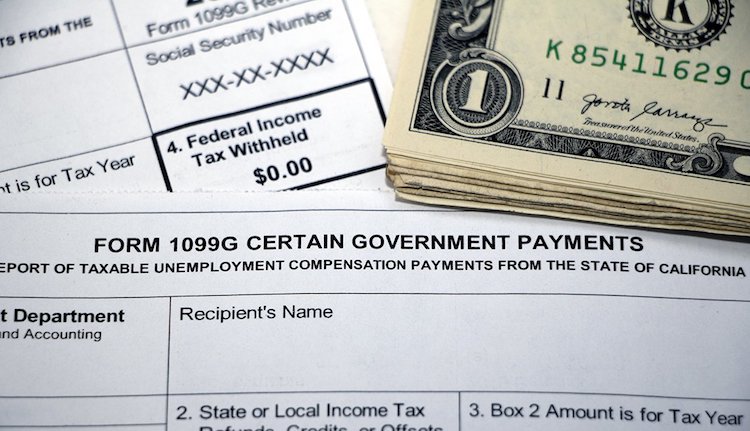

The Arizona Department of Revenue is warning that residents are receiving an unexpected unemployment benefits tax form that’s likely due to a fraud scheme.

The department is asking those who received the Form 1099-G for unemployment benefits they didn’t apply for to reach out to the Arizona Department of Economic Security for a corrected form.

In Arizona and nationwide, some taxpayers have fallen victim to fraudsters stealing personal information who then file claims for unemployment for themselves.

Unemployment benefits are taxable, so government agencies send the form to people who received them so they can report the income on their tax returns.

States are mailing 1099-Gs in huge numbers this year after processing and paying a record number of claims due to the COVID-19 pandemic.

Nearly 26 million people requested unemployment aid in the initial months after states began ordering shutdowns.

The unprecedented surge strained unemployment offices that are governed by federal rules but administered in patchwork fashion by state governments, with many relying on 1960s-era software to process applications and issue payments.

The federal government, as part of its $2 trillion relief package approved in March, significantly expanded jobless aid, making it a richer target for fraud.

By November, the U.S. Department of Labor’s Office of Inspector General estimated states had paid as much as $36 billion in improper benefits, with a significant portion of that blamed on fraud.